Probiotics Market By Ingredient (Bacteria, and Yeast), By Function (Preventative Healthcare, and Therapeutic), By Application, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Aug 2024

- Report ID: 18060

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

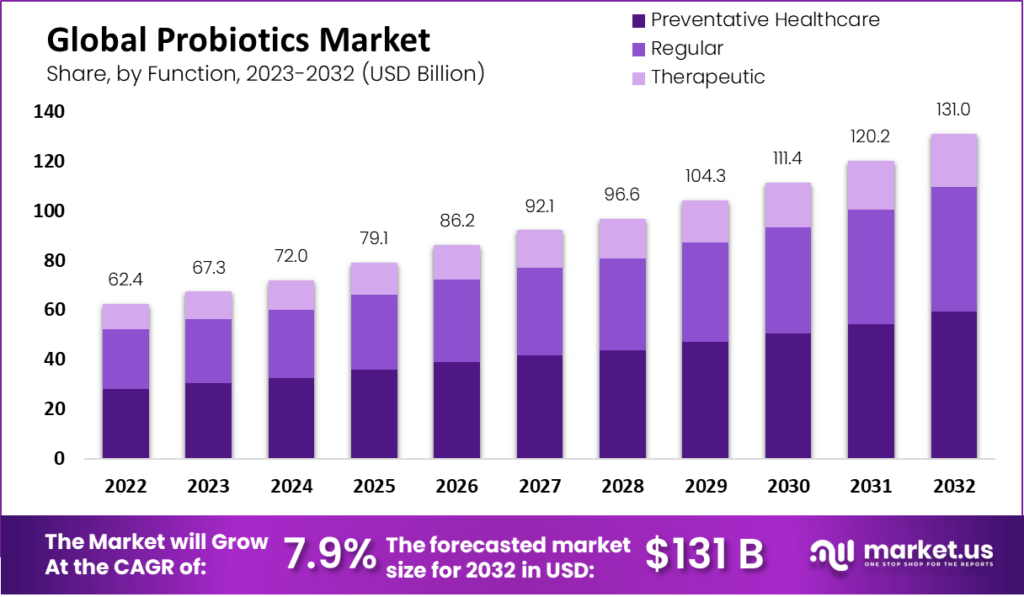

The Global Probiotics Market size is expected to be worth around USD 131 Billion by 2032 from USD 62.4 Billion in 2022, growing at a CAGR of 7.9% during the forecast period from 2022 to 2032.

Probiotics are useful bacteria that help in boosting health and gut microbiome, restore balance to the microbiome after an illness or treatment, and support the immune system. Probiotic consumption has been shown to modulate intestinal microbiota, increase short-chain fatty acid (SCFA) production, and reduce the risk of developing various diseases such as type 2 diabetes, irritable bowel syndrome, colon cancer, and obesity.

In addition, probiotics protect healthy organisms from harmful organisms. Probiotic products are now used to diagnose mental illnesses, as well as treat digestive problems and neurological disorders.

Key Takeaways

- Market Growth: The global probiotics market is projected to reach USD 131.0 billion by 2032, growing at a CAGR of 7.9%.

- Probiotic Benefits: Probiotics are beneficial bacteria/microorganisms that enhance gut health, support the immune system, and are used to treat various diseases, including mental illnesses, digestive problems, and neurological disorders.

- Ingredient Analysis: Bacteria, including lactobacilli, bifidobacterium, and streptococcus, dominate the probiotics market due to their health benefits.

- Function Analysis: Preventative healthcare is the dominant function of probiotics, with a focus on enhancing intestinal health and reducing the risk of various diseases.

- Application Analysis: Dietary supplements hold the largest market share, followed by food and beverages and animal feed.

- Distribution Channel Analysis: Supermarkets and hypermarkets are the dominant distribution channels, with online retail gaining traction due to convenience.

- End-Use Analysis: Probiotics are primarily used for human consumption due to increasing health concerns and a preference for natural, healthy foods.

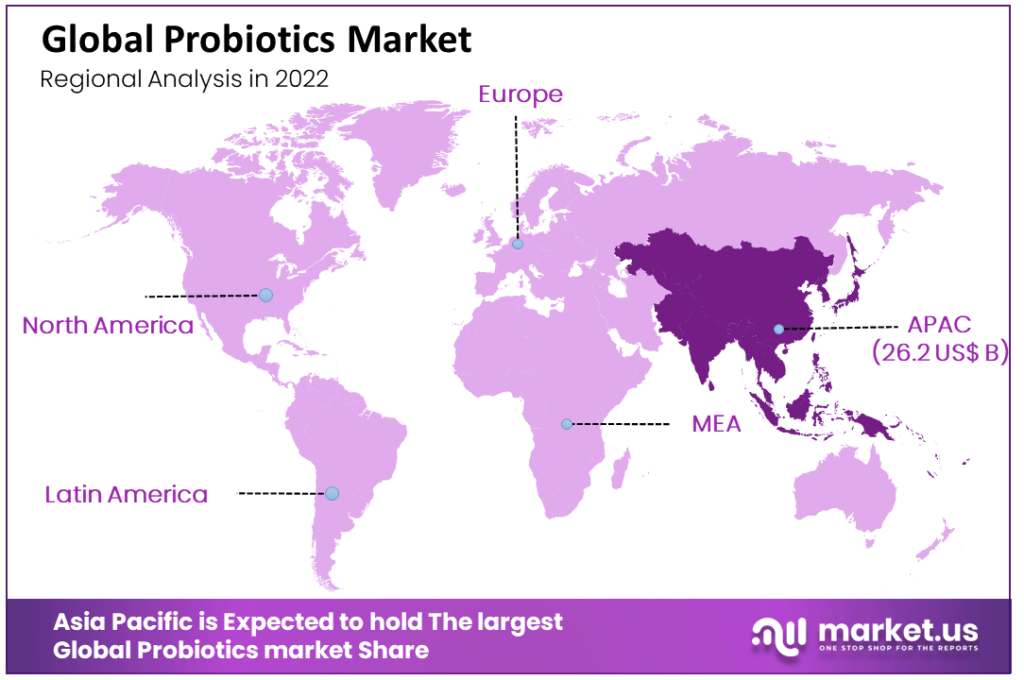

- Regional Analysis: Asia Pacific leads the global probiotics market, with strong demand in emerging countries like China and India.

- Key Players: Major players include BioGaia AB, Danone S.A., PepsiCo Inc., CHR Hansen, Yakult Honsha Co., Ltd., Nestle SA, and more.

Driving Factors

Increasing Health Awareness and Demand for Natural Products Driving the Probiotics Market

Growing consumer preference for natural products is a key factor in driving market growth. Growing consumer interest in health care and the health benefits of probiotics is the main factor for driving the expansion of the market. Demand for probiotics is increasing due to the increased consumption of functional foods that provide basic nutritional support and improve health.

The majority of individuals are suffering from digestive issues, gastrointestinal infections, digestive issues, and other ailments. Taking this into account, various market players are now focusing on probiotics production that aids the treatment of such diseases. Thus increasing concerns about health will drive the probiotics market during the forecast period.

Increasing Applications of Probiotics in Food & Beverage and Advancements in Distribution Channels

The growing food and beverage industry driven by rising consumer spending and cheap government support is expected to act as one of the major drivers of growth of the probiotics market. Growing demand for Fortified foods is expected to boost probiotics market growth during the forecast period.

Also, advancements in supermarkets and online retail stores provide door-step services to consumers, and also provide various varieties of products on a single platform, thus advancements in distribution channels will drive the global probiotics market during the forecast period.

Restraints Factors

Risk of Contamination to Hamper the Market Growth

Probiotics are live microorganisms and they contain products that are dependent on the cultivation by probiotic living organisms. The risk of contamination of probiotic products by microbes with high toxicity is anticipated to restrain the production of probiotics products.

In addition, high investment is required for the research and development of new probiotic bacteria, resulting in limiting the market growth.

Ingredient Analysis

Bacteria Segment is Dominant

By ingredient, the market is classified into bacteria and yeast. The bacteria segment is further classified into lactobacilli, bifidobacterium, streptococcus, and others. The bacteria segment holds the largest market share in the probiotics market in 2022. Lactobacillus has an inhibitory ability to lessen the growth of bacteria and pathogens, which is advantageous for extending shelf life and increasing the germ-free advantage of the food.

The Lactobacillus is helpful to humans due to its ability to reduce intestinal disease in humans, which is expected to positively impact product demand. Bifidobacterium helps to regulate the gut microbiome, prevent inflammation and protect against many diseases, including colorectal cancer, intestinal infections, diarrhea, inflammatory bowel disease (Crohn, ulcerative colitis), or even depression. Streptococcus thermophiles is extensively used as a starter culture in the production of yogurt and cheese.

The yeast segment is further classified into saccharomyces boulardii which is one of the widely used yeasts for the production of probiotic drinks. Yeast helps to regulate the intestines and protects the intestinal lining. Additionally, it regulates several parts of the immune system and keeps the intestinal barrier function running. Rising awareness regarding benefits associated with the consumption of probiotics products is expected to positively impact market growth.

Function Analysis

Preventative Healthcare Segment is Dominant

By function, the market is divided into regular, preventative healthcare, and therapeutic. The preventive healthcare segment led the market with the highest market share in 2022. This is due to a growing health problem that has prompted market players to invest in research and development and launch new and innovative probiotic products. Probiotic consumption has a large function in amelioration of symptoms of enhancement of intestinal health, reduction of the risk of various diseases, and lactose intolerance.

Additionally, probiotics show an important role in therapeutic functions like gastrointestinal health, constipation, cancer, liver diseases, and urogenital infection. Probiotics are also helpful in many communicable and non-communicable diseases.

Application Analysis

The dietary Supplements Segment is Dominant

Based on application probiotics market is classified into food and beverages, dietary supplements, and animal feed. The dietary supplements segment holds the largest market share in 2022. This is due to the fact that some dietary supplement manufacturers focus on adding special forms of fiber, including probiotics and prebiotics (FOS and sun fibers). Such dietary supplements help to fight against diarrhea, gas, eczema, and yeast infections. Probiotics are used in to increase the nutritional value of food. Food and beverages have become part of our daily diet and provide potential health benefits beyond the generally accepted nutritional effect.

Consumption of foods and beverages is now a trending diet in the world. The growing popularity of natural and healthy foods Products drives product sales during the forecast period. Probiotics have beneficial effects on animal health by altering the gastrointestinal (GI) flora. Gastrointestinal benefits for dogs and cats include maintaining a balanced and healthy gut microbiota, preventing diarrhea, and treating small intestinal bacterial overgrowth and inflammatory bowel disease.

Distribution Channel Analysis

The supermarkets and Hypermarkets Segment is Dominant

Based on distribution channel market is classified into supermarkets/hypermarkets, pharmacies/health stores, convenience stores, and online retail. The supermarkets and hypermarkets segment is dominant as they are major distributors of products due to various cashback or offers provided by them. Moreover, distinct varieties of probiotic products are available in supermarkets.

However, due to busy lifestyles and hectic schedules, consumers nowadays prefer to purchase products through online retail stores as they provide door-step delivery, which is anticipated to drive the online retail segment during the forecast period.

End-Use Analysis

The human segment is Dominant

By end-use market is classified into humans and animals. The human segment is dominant in the market due to a surge in health concerns and a rise in consciousness to keep the gut healthy, which has increased demand for probiotics amongst customers.

Also, consumers are nowadays inclined towards natural and healthy food, this is anticipated to increase the use of probiotics. In addition, probiotics also have significant applications in animal feed which help in digestion and treat other animal-related diseases.

Key Market Segments

Based on Ingredient

- Bacteria

- Yeast

Based on Function

- Regular

- Preventative Healthcare

- Therapeutic

Based on Application

- Food & Beverage

- Dietary Supplement

- Animal Feed

Based on Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies/Health Stores

- Convenience Stores

- Online Retail

Based on End-Use

- Human

- Animal

Growth Opportunity

Increasing Use in Food & Beverages Will Create Lucrative Growth opportunities in Probiotics Market

The Probiotic industry is also boosted due to growing food and beverage industries in several emerging economies such as Brazil, India, South Africa, and China. The rapidly increasing geriatric population, rising per capita income, rising disposable income, and spiking awareness among individuals are driving the need for enhancing the food and beverage industries in these nations.

Therefore, the governments in these economies are increasing their investments aimed at improving food facilities & infrastructure. Owing to the high number of applications of probiotic products in food and beverage industries, and dietary supplements the rising investment in this industry is slated to offer market opportunities in the market.

Latest Trends

Competitive Landscape of Manufacturers

Some independent manufacturers hire third-party suppliers to sell their products. Probiotics manufacturers are increasingly focused on product innovation and differentiation as they are steadily moving toward consolidation through mergers & acquisitions, joint ventures, and collaborative partnerships. Such trends are currently being witnessed in this market, thereby bolstering the demand for these probiotic products in the process.

Regional Analysis

Asia Pacific region is Dominant in the Global Probiotics Market

Asia Pacific Led the global probiotics market with the largest market share of 42% in 2022. Asia Pacific Region is observing an extensive rise in consumer awareness due to the competitive landscape of key players in the Asia Pacific region. Strong probiotic demand in emerging countries like China, India, and Australia contributes to the overall growth of the probiotic market. Furthermore, due to the growing food and beverage industries, the probiotic market is also boosting in several emerging economies such as Brazil, India, South Africa, and China.

The rapidly increasing geriatric population, rising per capita incomes, high health awareness, and spiking awareness among individuals are driving the need for enhancing the food industries in these nations. In North America, the advancements in R&D facilities and the technological adoption rate is greater. As such, the market for probiotics is anticipated to grow during the forecast period.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several probiotics market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the probiotics market are developing new products and portfolio expansion strategies through investments and mergers, and acquisitions. In addition, several key market players are now focusing on different marketing strategies such as spreading awareness about natural ingredients, which is boosting the target products’ growth.

Market Key Players

- BioGaia AB

- Lallemand Inc.

- Lifeway Foods, Inc.

- Danone S.A.

- PepsiCo Inc.

- Arla Foods, Inc.

- Morinaga Milk Industry Co. Ltd

- CHR Hansen

- Hansen Holding A/S

- Yakult Honsha Co., Ltd.

- Probi AB

- Lifeway Foods Inc.

- Nestle SA

- Ganeden, Inc.

- Kerry Inc.

- Post Holdings, Inc.

- Pepsico, Inc.

- Evolve Biosystems, Inc.

Recent Developments

- In April 2024: Arla Foods Ingredients acquired the Whey Nutrition business from Volac, specializing in whey protein for sports and health nutrition. The acquisition aims to transform the Felinfach site into a global production hub.

- In August 2023: Arla Foods reported its half-year results, noting a tough market with inflationary pressures. The company focused on sustaining brand performance, especially with its Starbucks and Arla Protein brands in the UK, despite market downturns.

- In 2023: Lifeway Foods expanded its probiotics offerings, launching Lifeway Probiotic Pills for adults and ProBugs Chewables for children. These new products aim to diversify the company’s portfolio beyond its traditional kefir products.

- In December 2023: Lallemand Inc., through Danstar Ferment AG, acquired Swiss biotech company Evolva AG from Evolva Holding AG. This acquisition enhances Lallemand’s health ingredients and flavor components, leveraging Evolva’s precision fermentation technology.

- In December 2023: Lallemand Bio-Ingredients finalized the purchase of Biotec BetaGlucans AS from ArticZymes Technologies in December 2023. This includes a production facility in Northern Norway, broadening Lallemand’s beta-glucans portfolio and yeast-based technologies for nutrition sectors.

Report Scope

Report Features Description Market Value (2022) US$ 62.4 Bn Forecast Revenue (2032) US$ 131 Bn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ingredient- Bacteria, and Yeast; By Function- Regular, Preventative Healthcare, and Therapeutic; By Application- Food & Beverage, Dietary Supplement, and Animal Feed; By Distribution Channel-Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, and Online Retail; By End-Use- Human, and Animal Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BioGaia AB, Lallemand Inc., Lifeway Foods, Inc., Danone S.A., PepsiCo Inc., Arla Foods, Inc., Morinaga Milk Industry Co. Ltd, CHR Hansen, Hansen Holding A/S, Yakult Honsha Co., Ltd., Probi AB, Lifeway Foods Inc., Nestle SA, Ganeden, Inc., Protexin., Kerry Inc. , Post Holdings, Inc. , Pepsico, Inc. , Evolve Biosystems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Probiotics Market in 2023?The Probiotics Market size is USD 62.4 Billion in 2023.

What is the projected CAGR at which the Probiotics Market is expected to grow at?The Probiotics Market is expected to grow at a CAGR of 7.9% (2023-2032).

Which region is more appealing for vendors employed in the Probiotics Market?Asia Pacific Led the global probiotics market with the largest market share of 42% in 2022.

Name the key business areas for the Probiotics Market.The US, Canada, China, India, Brazil, South Africa, Singapore, Indonesia, Portugal, etc., are leading key areas of operation for the Probiotics Market.

List the segments encompassed in this report on the Probiotics Market?Market.US has segmented the Probiotics Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented by Ingredient Bacteria and Yeast. by Function Regular, Preventative Healthcare and Therapeutic. by Application Food & Beverage, Dietary Supplement, and Animal Feed. by Distribution Channel Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Online Retail. by Human and Animal.

-

-

- BioGaia AB

- Lallemand Inc.

- Lifeway Foods, Inc.

- Danone S.A.

- PepsiCo Inc.

- Arla Foods, Inc.

- Morinaga Milk Industry Co. Ltd

- CHR Hansen

- Hansen Holding A/S

- Yakult Honsha Co., Ltd.

- Probi AB

- Lifeway Foods Inc.

- Nestle SA

- Ganeden, Inc.

- Kerry Inc.

- Post Holdings, Inc.

- Pepsico, Inc.

- Evolve Biosystems, Inc.